Whether growing from within or recruiting targeted industry firms, Utah’s economy continues to lead the nation with its business-friendly environment.

The office’s Business Incentives team recommends financial incentives for local and out-of-state companies seeking to expand or relocate to Utah. The Economic Opportunity Board votes on all proposed incentives in a public meeting. The office’s executive director provides the final sign-off on all awarded incentives.

Incentives are available to select companies creating new, high-paying jobs that improve quality of life, increase the tax base, and help diversify state and local economies.

Incentives are offered as tax credits or grants. They’re disbursed only after the company has met contractual performance benchmarks, including job creation, capital expenditure, and payment of new state taxes.

Since its 2005 inception, approximately two-thirds of the companies participating in the state’s tax credit incentive program are Utah-based companies.

The state Legislature created Utah’s incentives program. It’s called an Economic Development Tax Increment Financing (EDTIF) tax credit. The statute that governs Utah’s economic development incentives is titled U.C.A. 63N-2-106(2) and is available here.

The Utah Legislature created the Economic Development Tax Increment Financing (EDTIF) corporate incentive program in 2005. As the state’s needs and economy continue to evolve, the Legislature fine-tunes the EDTIF program to maintain Utah's robust environment for economic development.

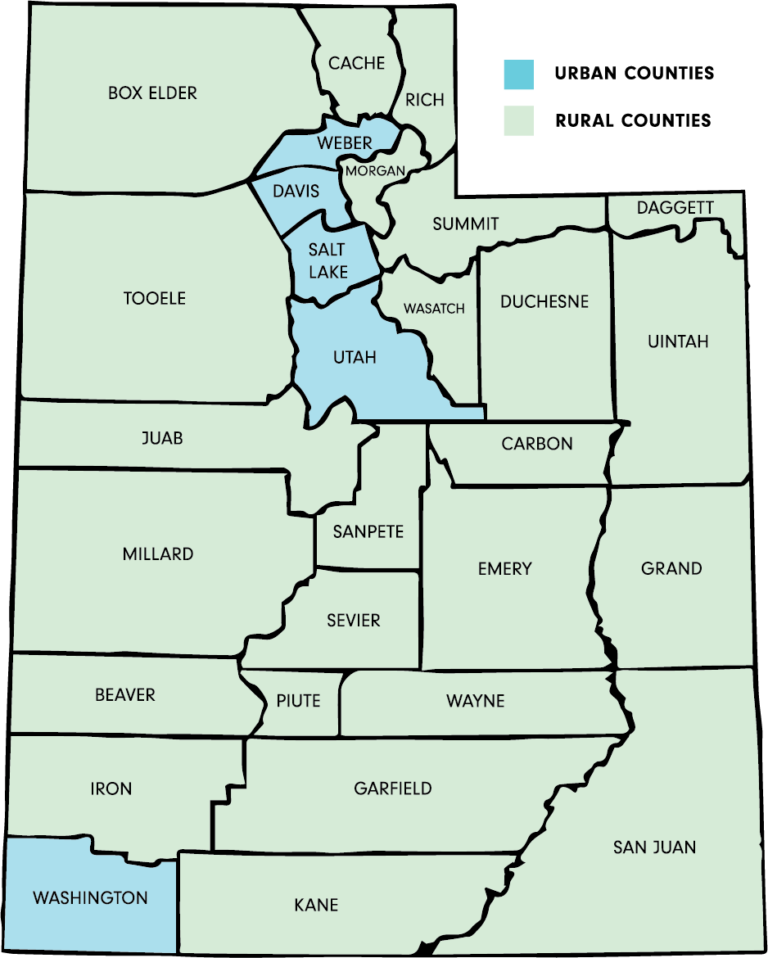

New guidelines from the 2022 legislative session focus on creating jobs throughout Utah while recognizing the unique challenges in the state's urban and rural areas.

Urban Counties

The EDTIF program is available for companies expanding in targeted industries in urban counties. These targeted industries include:

- Advanced Manufacturing

- Aerospace and Defense

- Financial Services

- Life Sciences and Healthcare

- Software and Information Technology

Rural Counties

The office may authorize additional, non-retail projects outside of these targeted industries in rural communities.

Additionally, with the rural modifications to the EDTIF program, known as REDTIF, projects within rural Utah qualify for more significant incentive amounts.

The office will evaluate projects applying for the EDTIF program, in urban and rural areas, on the following criteria:

- The average wage of planned new jobs

- Capital expenditure investment

- Type and number of new jobs created

- Whether or not the jobs are related to headquarters or innovation operations

- The company’s corporate citizenry efforts

The table below outlines how the EDTIF program applies in different areas of Utah.

| Urban | Rural | Most Rural | |

| Requirements | |||

| Project located in Salt Lake, Davis*, Utah*, Washington*, or Weber* counties | Project located in Box Elder, Cache, Iron, Summit, or Tooele counties | Project located in all other counties | |

| Project must be in one of five strategic targeted industries | Targeted industry preferred but not required | Targeted industry preferred but not required | |

| New jobs created must pay at least 110% of the average county wage | New jobs created must pay at least 100% of the average county wage | New jobs created must pay at least 100% of the average county wage | |

| Percentage of new state tax revenue from the project that may be given in a post-performance tax credit | Up to 30% | Up to 30% in most cases and up to 50% for very large projects | 50% for all qualifying projects |

*For the EDTIF program, incorporated towns within these counties that have fewer than 10,000 residents are considered rural.