The Utah Governor’s Office of Economic Opportunity announced today that Utah-based businesses continued to perform and further invest in the state during the 2023 fiscal year (FY23). The Economic Opportunity office administers the Utah Legislature’s Economic Development Tax Increment Financing (EDTIF) tax credit program. It provides a post-performance tax credit that offers companies a reduction in their marginal tax rates, up to 30% of new state tax revenues (Utah sales, corporate income, and state payroll withholding taxes), during a defined period (typically 5 to 10 years).

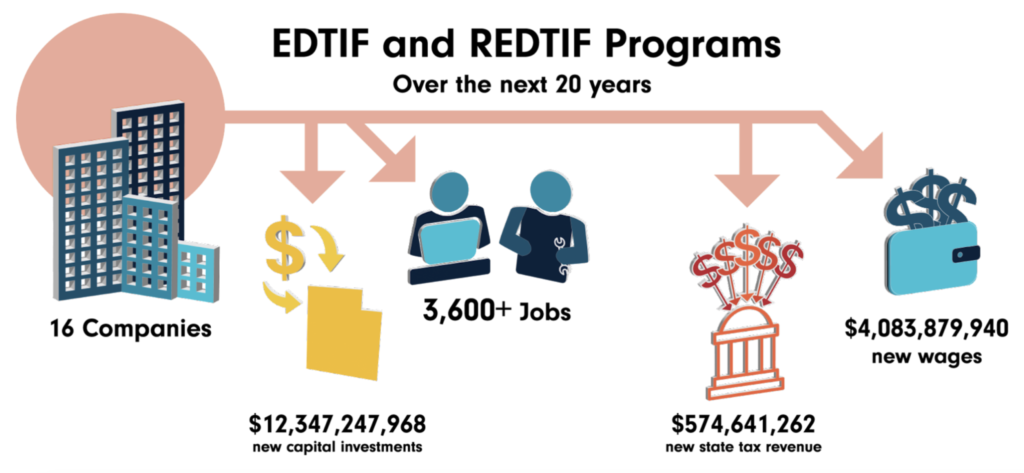

This fiscal year, Utah experienced a greater than 500% increase in new capital investments compared to the previous year. The average capital expenditure per project rose due to an increase in investments in industries such as technology and automation. From July 2022 to June 2023, 16 companies participated in the state’s EDTIF program and are collectively projected to create 3,630 new jobs, make $12,347,247,968 in new capital investments, pay more than $574,641,262 in new state tax revenue, and provide $4,083,879,940 in new state wages over the next 20 years.

“This has been a historic and prosperous year for Utah’s economic growth,” said Ryan Starks, executive director of the Utah Governor’s Office of Economic Opportunity. “We met new milestones, including the largest economic investment in Utah history with the expansion of Texas Instruments. The EDTIF and REDTIF tax incentive programs continue to attract investments from companies representing a variety of industries, and I want to express thanks to our team for their collective efforts.”

Created by the Legislature in 2005, the EDTIF program is for companies offering high-wage jobs — paying at least 110% of the average county wage. By design, the program has a multiplier effect, creating additional jobs that support corporate expansion across Utah’s diverse economy.

In FY23, the EDTIF program remained strong. Utah maintained its status as one of the best locations for businesses looking to expand. Trends for the year included more projects that chose locations away from the Wasatch Front and into rural Utah.

The Rural Economic Development Tax Increment Financing (REDTIF) tax credit program is a recent rural modification of the EDTIF program that allows projects located in rural areas to qualify for more significant incentives. With this tool, the state has seen unprecedented economic opportunities flow to its more rural communities. The projected capital investment in rural Utah from announced projects in FY23 amounts to more than $1.2 billion, the same as in 2022, with more than double the capital investment of 2017-2021 combined that rural Utah has seen from state incentives.

The tax credit is available to Utah companies expanding and other businesses relocating or establishing additional operations in Utah. Utah-based companies have most often used the tax credit. Since its inception, about two-thirds of the program’s tax credits have gone to Utah-based companies to help them expand and create more jobs for Utahns.

“Our state continues to do a phenomenal job of retaining and recruiting companies that bring more high-paying jobs to Utah and continue to diversify our economy,” said Carine Clark, Economic Opportunity office board chair. “This is a direct result of our combined efforts that result in strategic economic plans.”

“We’re proud of the collaborative efforts that have helped create and sustain high-paying jobs for Utahns,” said Scott Cuthbertson, president and CEO of EDCUtah. “The companies choosing to invest in Utah are leaders in their respective industries and good corporate citizens. They will have an immense impact on the prosperity of our communities for generations to come.”

Learn more about the state’s post-performance EDTIF/REDTIF program here.